Executive Vice President and Chief Strategy Officer Christopher Rogers sold 5,017 shares of PENN Entertainment Inc (NASDAQ:PENN) on January 3, 2024, according to a recent SEC Filing. The transaction was executed with a stock price of $25.23 per share, resulting in a total sale amount of $126,579.91. PENN Entertainment Inc is an American gaming company that operates casinos and racetracks. It is the largest gaming company in the United States, with properties including gaming and racing facilities focused on slot machine entertainment. The company also operates an online gaming division through its subsidiary Penn Interactive Ventures, which operates sports betting and online casino gaming businesses. Over the last year, the insider sold a total of 5,017 shares and made no purchases of the company's stock. .

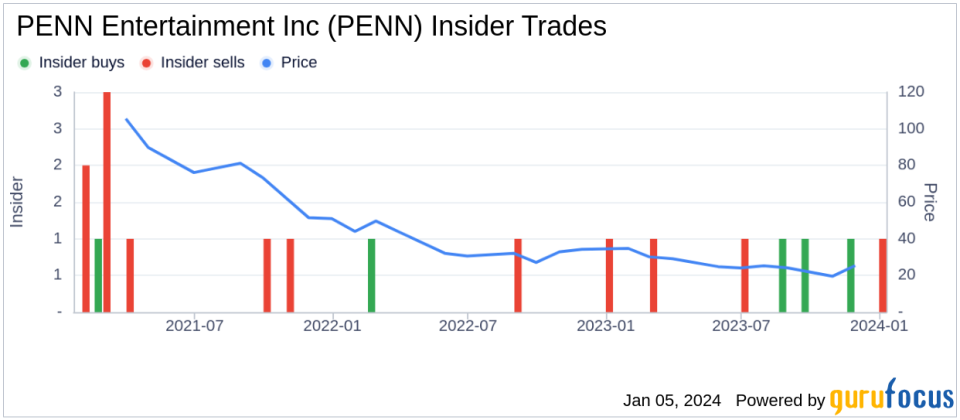

The insider trading history for PENN Entertainment Inc shows a trend of more insider selling than buying over the last year. There were 3 insider purchases and 4 sales during this period. As of the date of the recent insider transaction, PENN Entertainment Inc had a market capitalization of $3.726 billion.

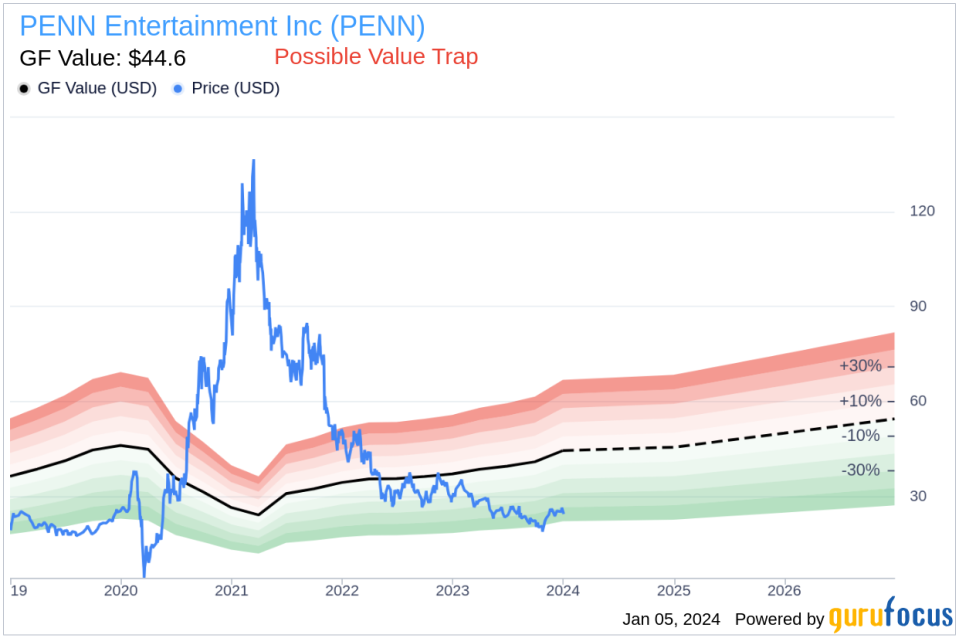

The sale day stock price of $25.23, compared to the GuruFocus Value (GF Value) of $44.60, indicates a Price to GF Value ratio of 0.57. This suggests the stock is a possible value trap, think twice, depending on its GF value. GF Value is determined by taking into account historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-earnings ratio. to free cash flow, as well as a GuruFocus adjustment factor based on the company's historical returns and growth, as well as Morningstar analysts' estimates of future business performance.

This article, generated by GuruFocus, is designed to provide general information and does not constitute personalized financial advice. Our comments are based on historical data and analyst projections, using unbiased methodology, and are not intended to act as specific investment advice. It makes no recommendation to purchase or sell shares and does not take into account individual investment objectives or financial situation. Our goal is to provide long-term, data-driven fundamental analysis. Please be aware that our analysis may not incorporate the most recent price-sensitive company announcements or qualitative information. GuruFocus has no position in any stocks mentioned here.

This article first appeared on GuruFocus.