I disclosed the financial results for the 2023 quarter, and the operator circled the year with a gain of R$5.42. This is an expressive number that allows the operator to reduce losses and remove the card from Oi Fibra customers.

Check the main financial indicators of the Oi in 2023 and compare them to the previous year:

| Indicator | 2023 | 2022 | Difference |

|---|---|---|---|

| Liquid recipe | R$9.71 tickets | R$ 12.6 tickets | -22.9% |

| Liquid Prejuizo | R$5.43 tickets | R$29.26 tickets | -71.8% |

| Capex (investments) | R$869 million | R$ 3.85 tickets | -77.5% |

Oi Fibra tem alta na receita e customers

At Oi, divide the recipe between two segments:

- received the core, which meets Oi Fibra and the corporate services segment;

- non-basic reception, which includes services that are not relevant to the business — such as landline cable and satellite television.

I attribute income to receiving cash for non-essential services. Core services meet 72% of business needs. In this segment, the figures stand at 5.7% per year — particularly in fiber broadband, which is growing by 10.5%.

On the insulation, a wide strip of Oi Fibra was received for R$4.42 this year. The ARPU (gasto médio mensal por usuário) was R$ 91, and it is still comparable to the previous year. Currently, the plan is more affordable than that of Oi Fibra for R$79.90 per month, with a speed of 200 Mb/s.

In Oi Fibra, the year 2024 ended with 4.02 million connected homes, an increase of 2.9%. Regarding liquids, it is an annual amount of 119 million, or 77.5% in an annual comparison report.

The operator says it has increased access to broadband with a maximum speed of 300 Mb/s, with an increase of 1.1 million accesses this year. This represents 40% of the total from large operators like Claro, TIM and Vivo.

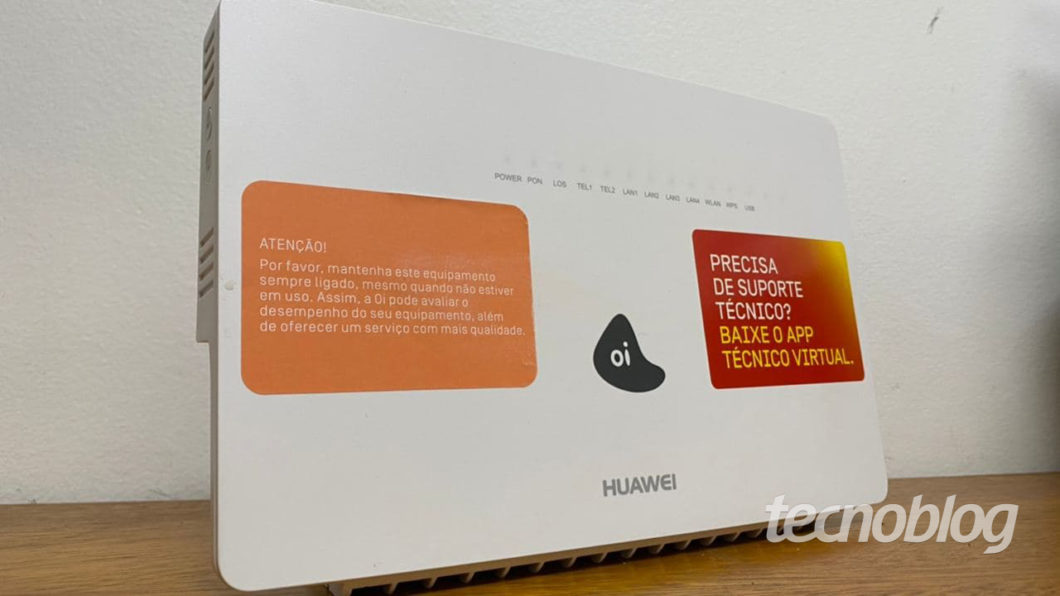

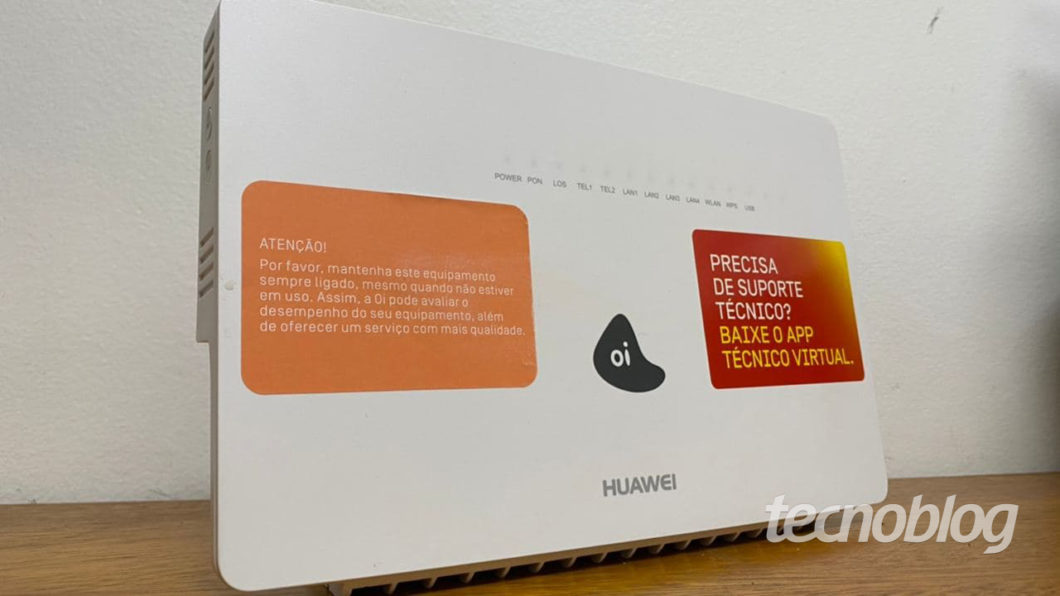

Oi Fibra circled the year with a market presence in 296 cities. The service used rede neutral V.tal (da qual a Oi é sócia), et tem cobertura em 22.1 milhões de domicílios (past house) in all states of Brazil. Vale lembrar que essa mesma infrastrutura também atende concurrents como Claro, Sky, T.I.M. And various regional or digital companies can sell large band with precise construction of fiber optic infrastructure.

Oi Fibra can be sold for the same

A Oi não believes that the Oi Fibra customer card could be sold. The commitment to operator continuity is not the segment of solutions that take care of businesses with a dedicated link, IT services, cloud telephony, security, among others.

A report to do Economic value it turns out that the operator plans the customer card of Oi Fibra por regiões. Between people interested in Alares, Desktop, Vero and Sky.

To avoid the crisis, I also planned to migrate to the public private concession regime. This is why the company saves its maintenance expenses in terms of revenue. For this, a precise agreement was confirmed by the Tribunal de Contas da União (TCU).