Long-term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see other investors take a loss. Spare a thought for those who held The Star Entertainment Group Limited (ASX:SGR) for five whole years – while the share price fell 88%. And some of the more recent buyers are probably worried too, with the stock falling 71% over the past year. The falls have accelerated recently, with the stock price falling 14% over the past three months. While such a drop is definitely a blow, money isn't as important as health and happiness.

So let's take a look and see if the company's long-term performance has been in line with the progress of the underlying business.

Check out our latest analysis for Star Entertainment Group

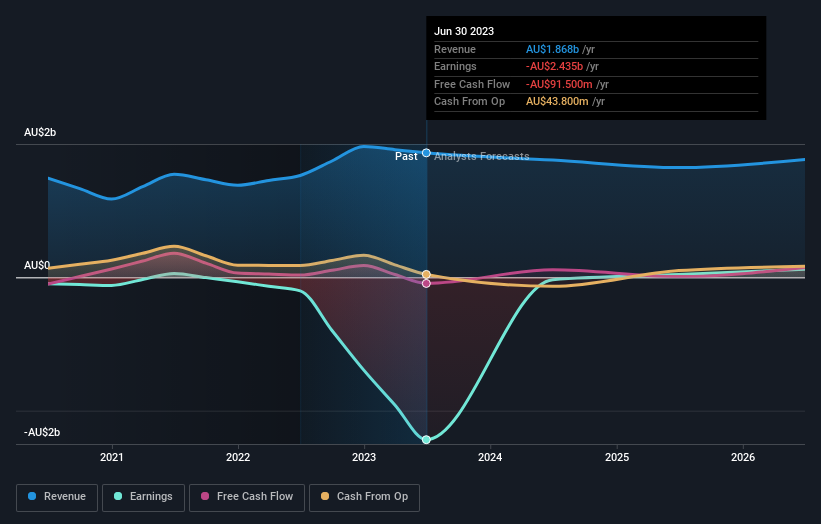

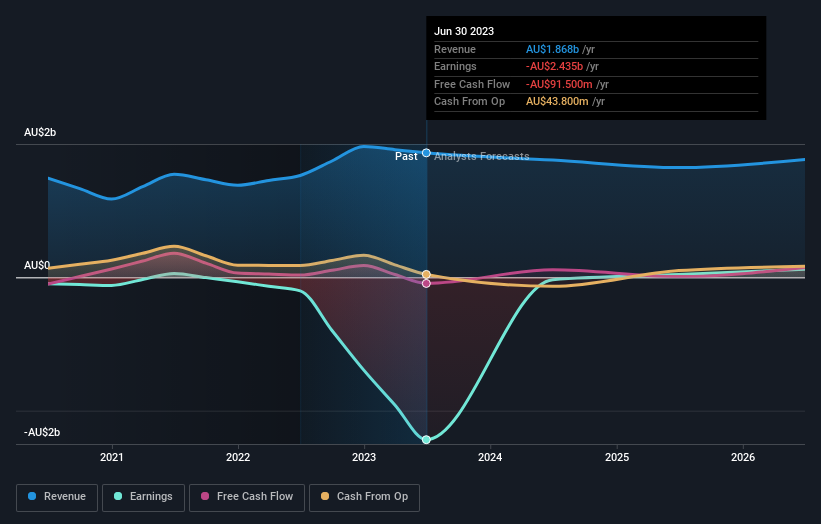

Star Entertainment Group was not profitable in the last twelve months, so we are unlikely to see a strong correlation between its share price and its earnings per share (EPS). Income is arguably our second best option. When a company isn't making a profit, we'd generally expect good revenue growth. Some companies are willing to postpone profitability in order to increase revenue faster, but in this case good revenue growth can be expected.

For more than half a decade, Star Entertainment Group has reduced its trailing twelve month revenue by 6.0% for each year. This is generally not what investors want. If a company is losing money, you want it to grow, so it's no surprise that the stock price has fallen 13% each year during this time. We're generally opposed to companies with declining revenues, but we're not alone. This is not really the goal of the successful investors we know.

The company's revenue and profit (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there has been significant insider buying over the last three months. This is a positive point. On the other hand, we think revenue and earnings trends are much more meaningful measures of the business. So it makes perfect sense to check out what analysts think Star Entertainment Group will earn in the future (free profit forecasts).

What about total shareholder return (TSR)?

Investors should note that there is a difference between Star Entertainment Group's total shareholder return (TSR) and its share price performance, which we discussed above. The TSR is a return calculation that takes into account the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been very beneficial to Star Entertainment Group shareholders, and this cash payout explains why the total loss of 85% to shareholders, over the last 5 years, is not as bad as the stock's share price performance. the action.

A different perspective

While the market as a whole has gained about 14% over the past year, Star Entertainment Group shareholders have lost 65%. Even good quality stock prices fall sometimes, but we want to see improvements in a company's fundamentals before we get too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 13% annualized loss over the past five years. We realize that Baron Rothschild said investors should “buy when there is blood on the streets”, but we caution that investors should first ensure they are buying a high quality business. I find it very interesting to look at stock prices over the long term as an indicator of a company's performance. But to really understand better, we need to consider other information as well. Consider, for example, the ever-present specter of investment risk. We have identified 2 warning signs with Star Entertainment Group (at least 1 that cannot be ignored), and understanding them should be part of your investment process.

Star Entertainment Group isn't the only stock that insiders are buying. For those who like to find winning investments This free A list of growing companies with recent insider buying could be just the ticket.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently traded on Australian stock exchanges.

Any feedback on this article? Worried about the content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to constitute financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your objectives or your financial situation. Our goal is to provide you with targeted, long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.